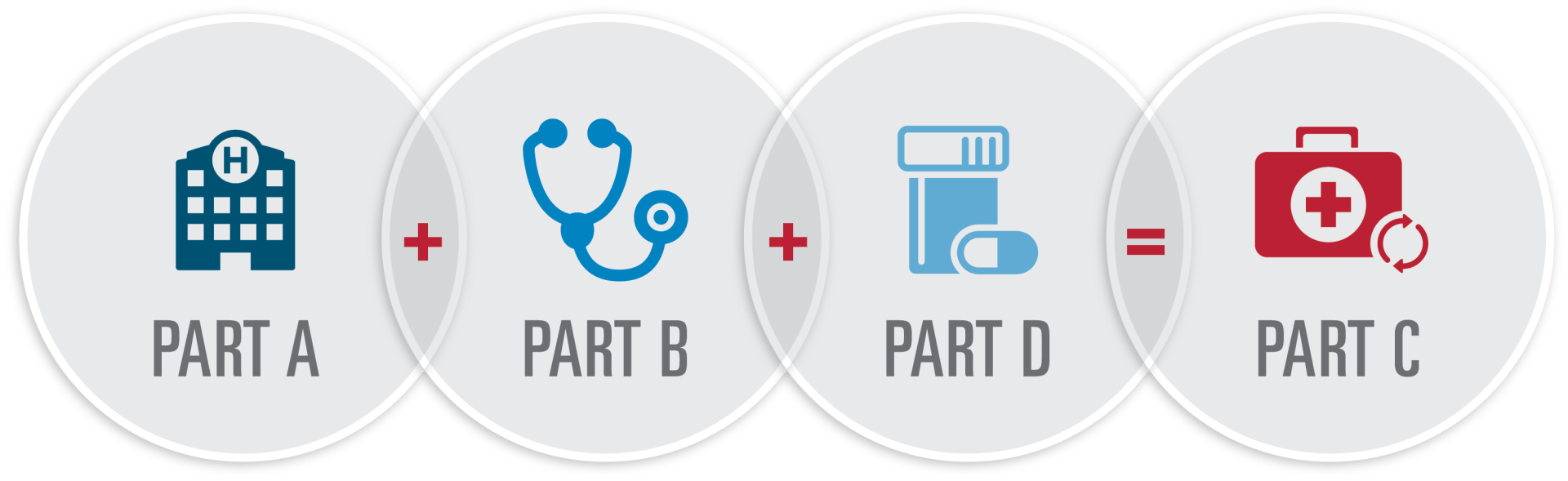

What does each part cover? Expand each section to learn more.

Medicare Q&A

What is a Medicare Supplement (Medigap) policy?

A Medigap policy helps cover the remaining medical cost that Original Medicare doesn’t cover. If you already have a Medigap policy, we may be able to help lower your costs. Many carriers offer discounts such as a Household Discount (two enrolled members in a household) which can lower monthly premiums.

Please note, we do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.